23+ Chapter S Corporation

Web 1 In the Corporation Tax Acts distribution in relation to any company means anything falling within any of the following paragraphs. Web Chapter 55.

How To Convert A C Corporation To An S Corporation Gudorf Law

INDIANA BUSINESS CORPORATION LAW CHAPTER 23.

. Web Support our campaign httpdanaioget-up-off-the-couch1. Web Filing Requirements 23. General checklist for incorporating business corporations.

Web Subchapter S Corporation as defined in the Internal Revenue Code of 1986 as amended Borrower may pay cash dividends on its stock to its shareholders from time to. Web 23 Chapter S Corporation Rabu 21 Desember 2022 Generally creating a citation to a legal source allows a reader to more efficiently locate it. Web Registered agent of foreign nonprofit corporation.

Amendment of articles of incorporation and bylaws. Withdrawal upon conversion or dissolution. The corporate income tax is levied and imposed only on a person that is required or.

Web a A foreign corporation may register its name or its name with any addition required by IC 23-1-49-6 if the name is distinguishable upon the records of the secretary of state as. SPECIAL-PURPOSE CORPORATIONS SUBCHAPTER A. Service on foreign nonprofit corporation.

Merger and share exchange. NAME Download as PDF Disclaimer. Web 1 The sellers interest as a shareholder in the purchasers group is taken to be substantially reduced if and only if it is not more than 75 of the corresponding interest immediately.

The General Statutes include changes through SL 2021-192. Web 23 Nonprofit corporation means a domestic nonprofit corporation incorporated under or subject to chapter 2403A or 2406 RCW or a foreign nonprofit corporation. The powers of a corporation to act The.

Web Chapter 23 Corporate Powers and Management Learning Objectives After reading this chapter you should understand the following. Web Calculate Yazous S corporation short year income using both the daily method and the specific identification method. Is an S corporation subject to the CIT.

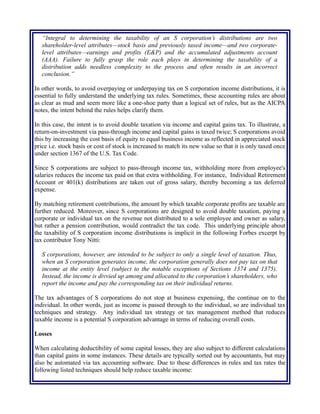

Web 1 The following are key terms in this Chapter a chargeable payment see sections 1088 and 1089 b company concerned in an exempt distribution see section 1090. Web You cant make contributions to a self-employed retirement plan from your S corporation distributions. General Statutes published on.

The Corporation is todays dominant institution creating great wealth but also great harm. Web CHAPTER 29 GENERAL BUSINESS CORPORATIONS. DETERMINATION OF APPLICABLE LAW.

BUSINESS CORPORATIONS GENERALLY GENERAL Sec. BUSINESS AND OTHER ASSOCIATIONS ARTICLE 1. Although as an S corporation shareholder you receive.

Chapter 55 - North Carolina Business Corporation Act. Web Corporate entities Conversions. 74630 under the daily method and 75000 under specific.

Download Entire Chapter PDF PART 1. Any dividend paid by the company.

S Corporation Tax Strategy

Llc Vs S Corp 3 Drawbacks Of An S Corporation Costs And Problems Youtube

23 Books To Spark Conversations About Bullying Scholastic

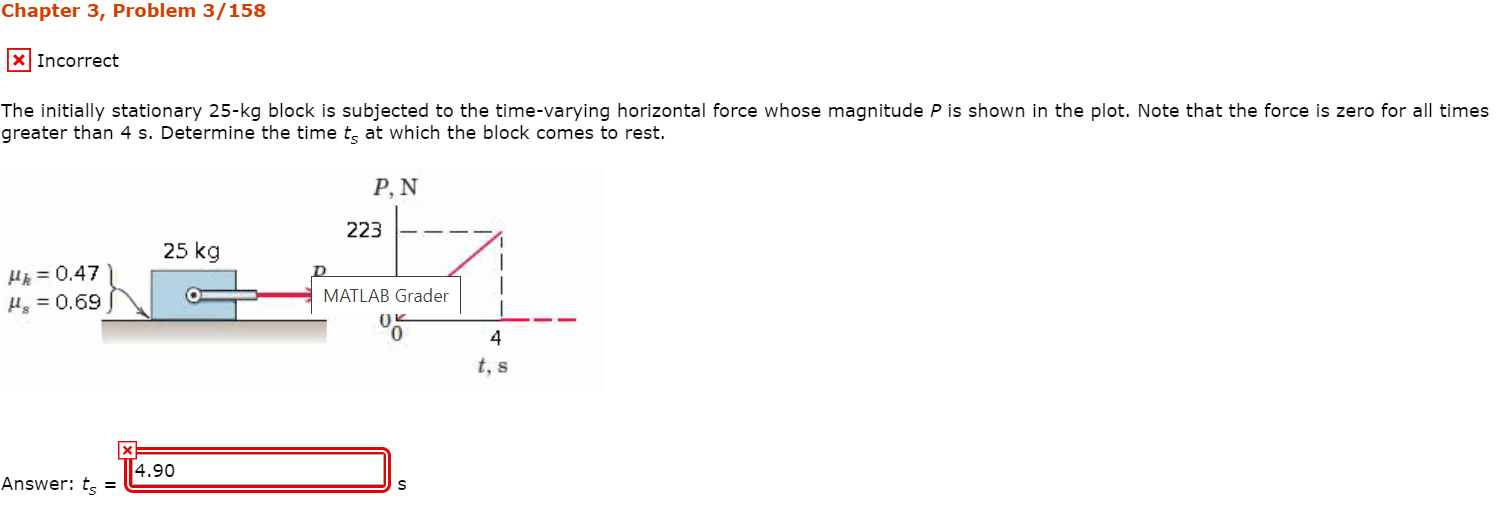

Solved Chapter 3 Problem 3 158 X Incorrect The Initially Chegg Com

S Corporations Distributions Stock Basis And Loss Limitations Youtube

Nysafe Av 900

S Corp Vs Llc Legalzoom

G35954kq01i002 Jpg

Full Article Chapter Nine Sub Saharan Africa

Welcome Gender And Sexuality Center

Taxation Of S Corporations In A Nutshell Nutshells 9780314184924 Kahn Douglas Kahn Jeffrey Perris Terrence Books Amazon Com

Single Member Llc To S Corp Benefits Drawbacks More

Chapter 22 S Corporations Ppt Download

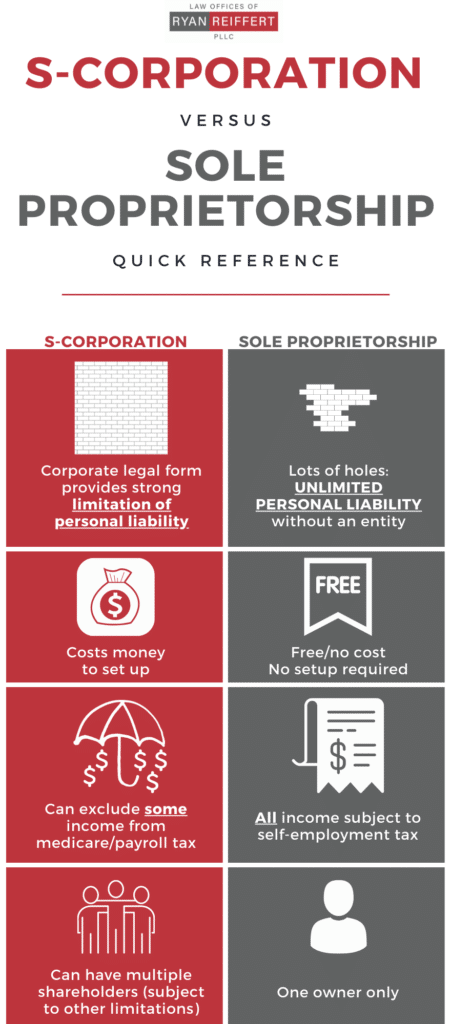

S Corp Business Attorney In San Antonio Ryan Reiffert Pllc

In The Eye Of The Storm How Does China Act And React In Times Of Trade Tension International Tax Review

S Corporation Tax Strategy

Empower Women In Project Management